Securing your financial future through retirement planning is essential, and there’s a great tool at your disposal: your employer’s matching program. In this blog post, we dive into the incredible benefits of leveraging your employer’s matching contributions for both your Tax-Free Savings Account (TFSA) and Registered Retirement Savings Plan (RRSP). Discover how you can maximize your retirement savings while enjoying the perks of your employer’s matching program.

Understanding the Hidden Gem: Employer Matching Programs:

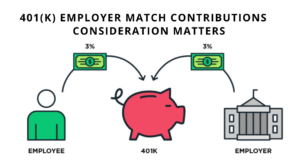

Did you know that your employer’s matching program is basically “free money?” These highly valuable benefits are offered by many companies, enabling you to contribute to your TFSA or RRSP while your employer generously matches a significant portion. Imagine doubling your savings potential effortlessly! For example, let’s say you make $50K annually and contribute $1000 (2% of your salary) towards your TFSA or RRSP. Your employer then adds another $1000, instantly doubling your initial investment. By actively participating in your employer’s matching program, you have the chance to significantly boost your retirement savings with no extra effort or cost. Imagine receiving “free money” from your employer that amplifies the impact of your contributions and accelerates the growth of your investments.

Tax Advantages Unveiled: TFSA and RRSP:

Let’s explore the remarkable tax advantages of TFSA and RRSP contributions. With a TFSA, your contributions are made with after-tax income, offering tax-free growth and withdrawals. Picture your investments growing tax-free! On the other hand, RRSP contributions are made with pre-tax income, reducing your taxable income and deferring taxes on investment growth until retirement. While both options have their merits, I prefer the flexibility of TFSA withdrawals in case of emergencies. The key is to choose the one that aligns with your financial goals and tax strategy.

Long-Term Savings and the Magic of Compound Growth:

When it comes to maximizing the benefits of employer matching, two fundamental principles reign supreme: starting early and making consistent contributions. As your income grows, seize the opportunity to leverage higher contribution limits and optimize your retirement savings potential. Long-term savings and the compounding growth of your investments are the secret ingredients for building a substantial retirement fund. By harnessing your employer’s matching program, you set yourself up for long-term success. Begin early, stay committed to regular contributions, and witness the exponential growth of your retirement savings over time. The compounding effect magnifies your wealth, ensuring you enjoy the rewards of a larger nest egg when you embark on your well-deserved retirement journey.

Achieving Unwavering Financial Security in Retirement:

A secure and worry-free retirement is the ultimate objective for many individuals, and employer matching plays an indispensable role in turning this dream into a reality. By actively participating in your employer’s matching program, you’re effectively increasing the overall value of your TFSA or RRSP, establishing a robust financial foundation for your retirement. The additional contributions from your employer provide a significant boost to your savings and act as a safety net, bridging any potential gaps in your retirement income. Embracing this invaluable employee benefit demonstrates your proactive steps towards securing your financial future, guaranteeing a comfortable and stress-free retirement.

Conclusion:

Supercharge your retirement savings by unlocking the full potential of your employer’s matching program for your TFSA and RRSP. Capitalize on this incredible benefit to amplify your contributions, accelerate investment growth, and achieve unparalleled financial security in retirement. Today is the day to seize the opportunity and embark on a path towards a comfortable and prosperous retirement. Don’t miss out—start capitalizing on your employer’s matching program now and unlock the secrets to a brighter future.